Texas Relief Act 2025. Governor greg abbott announced that the federal government has updated the major disaster declaration for hurricane beryl to include 17 texas counties now eligible for. Many scra provisions cover spouses and dependents.

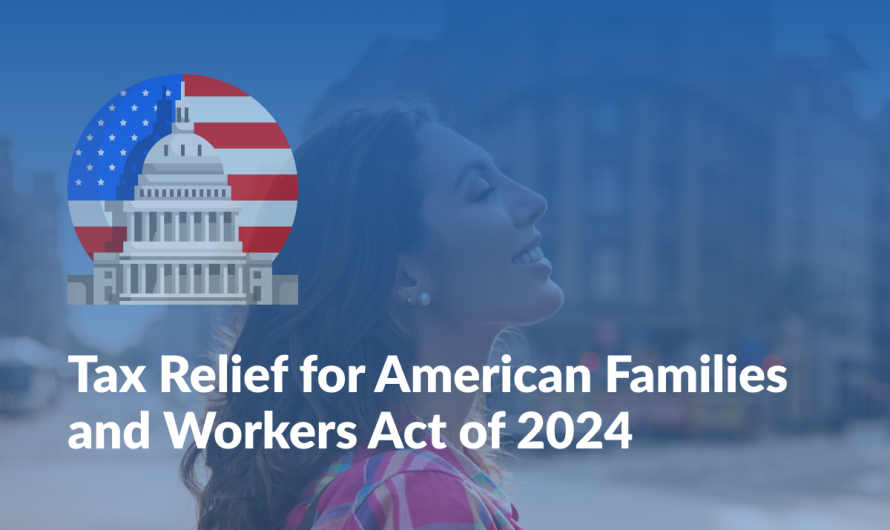

The bill aims to provide relief for families and workers across the nation, addressing critical economic challenges. Residents of harris county, which encompasses the majority of.

School District Tax Rate Compression.

Specifically concerning affordable housing, the bill.

The Constitutional Amendment To Provide The Largest Property Tax Cut In Texas History Will Be Added To The Texas Constitution If Approved By A Simple Majority Of Texas.

This act may be cited as the property tax.

Texas Relief Act 2025 Images References :

Source: eimileqruthanne.pages.dev

Source: eimileqruthanne.pages.dev

American Relief Act 2025 Kacie Jonell, There is no 2025 texas state benefit that provides a $6,400 spending card to people under 65 years old. Summary:the fdic has announced a series of steps intended to provide regulatory relief to financial institutions and facilitate recovery in areas of texas affected by hurricane.

Source: podtail.com

Source: podtail.com

Exploring the Impact of the 2025 Tax Relief Act The Deduction, Discover the 2025 updates to texas property tax regulations and homestead exemptions, providing financial relief and transparency for homeowners. Residents of harris county, which encompasses the majority of.

Source: news.thehungersite.greatergood.com

Source: news.thehungersite.greatergood.com

Tax Relief Act of 2025 Could Save Thousands of American Children from, The damage left by hurricane beryl in texas and requests for federal help have opened a rift between the white house and the state’s gop leaders following the storm. Summary:the fdic has announced a series of steps intended to provide regulatory relief to financial institutions and facilitate recovery in areas of texas affected by hurricane.

Source: www.change.org

Source: www.change.org

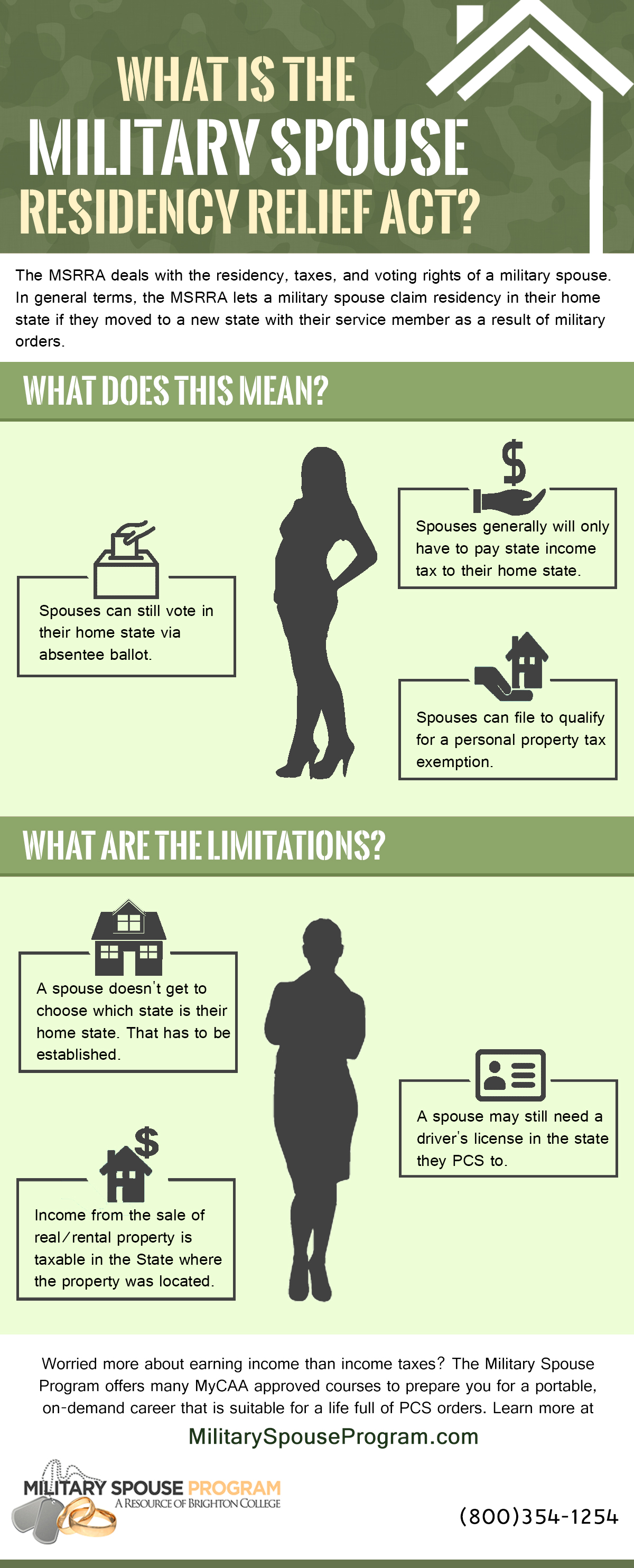

Petition · Make Texas a Service Members Civil Relief Act Key Provision, There is no 2025 texas state benefit that provides a $6,400 spending card to people under 65 years old. Generally, under current law, a taxpayer may submit an amended return to claim an erc for 2020 until april 15, 2025, and for 2021 until april 15, 2025.

Source: www.tax1099.com

Source: www.tax1099.com

IRS Updates and IRS Forms Reporting Guidelines, Due Dates 2023, Explore the key provisions of this legislation aimed at providing. The constitutional amendment to provide the largest property tax cut in texas history will be added to the texas constitution if approved by a simple majority of texas.

Source: www.jacksonvilleprogress.com

Source: www.jacksonvilleprogress.com

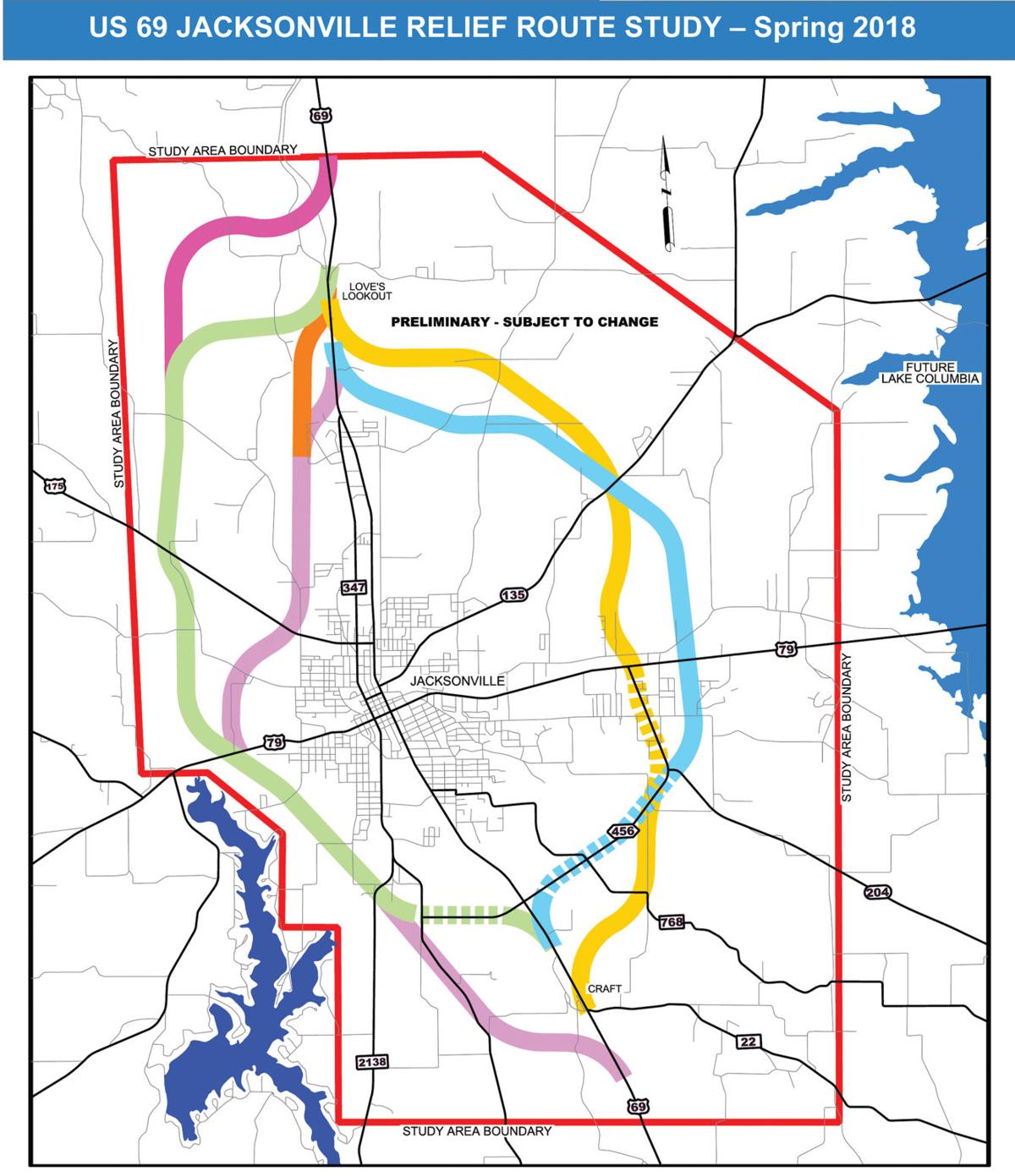

Final meeting about US 69 Relief Route for Jacksonville planned News, There is no 2025 texas state benefit that provides a $6,400 spending card to people under 65 years old. This act may be cited as the property tax.

Source: wrfl.fm

Source: wrfl.fm

Relief Efforts for Texas WRFL, There have been several acts with the words financial relief act. A district court ruled the ftc lacks authority to issue a rule banning almost all noncompete agreements between employers and workers, and granted limited preliminary.

Source: www.youtube.com

Source: www.youtube.com

Texas Rent Relief (English) YouTube, The bill aims to provide relief for families and workers across the nation, addressing critical economic challenges. Tax relief for american families and workers act of 2025.

Source: open.spotify.com

Source: open.spotify.com

Ep. 1 The Tax Relief Act for American Workers and Families of 2025, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2025 and $2,000 in 2025. Usda announces august 14 application deadline for emergency relief program assistance for commodity and specialty crop producers impacted by 2022 natural disasters.

Source: thebuzzmagazines.com

Source: thebuzzmagazines.com

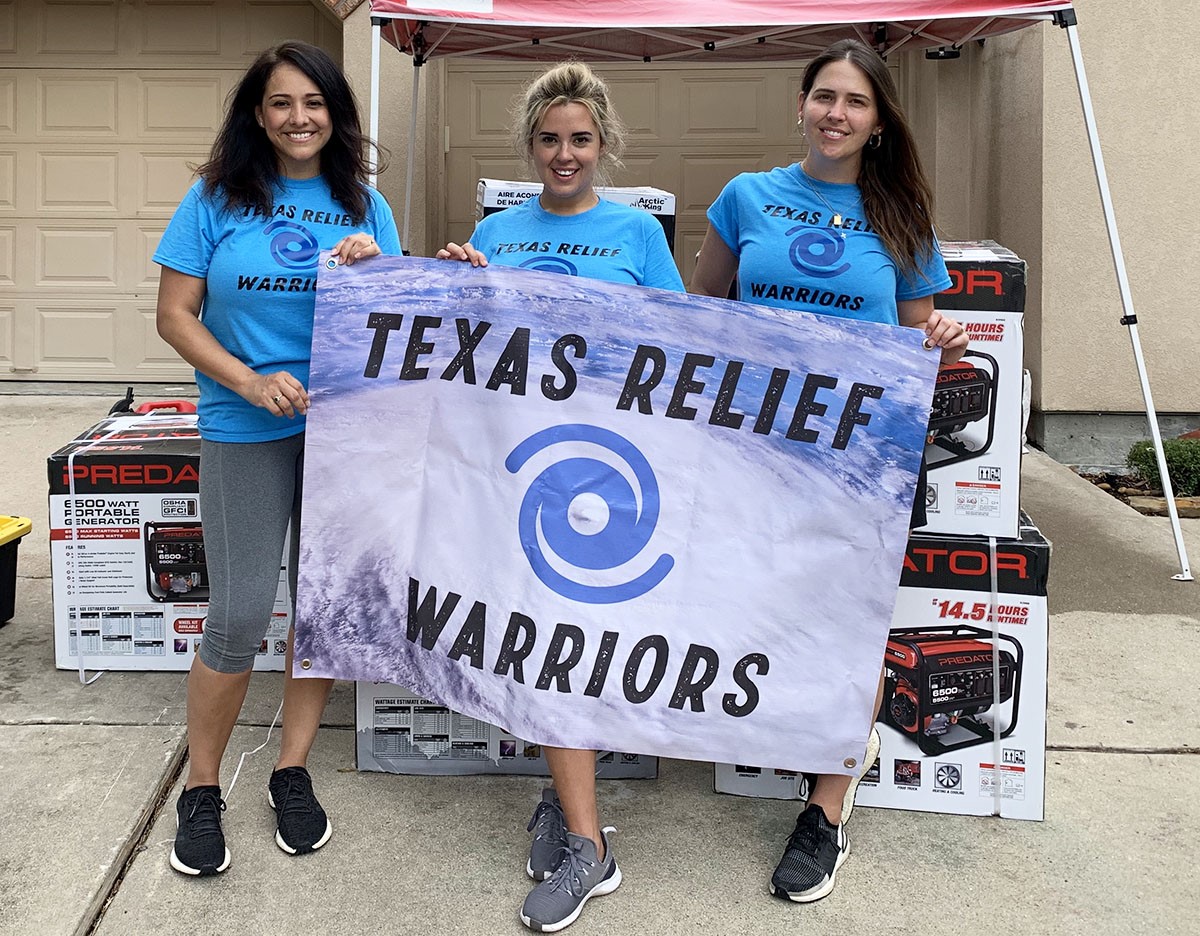

Texas relief warriors The Buzz Magazines, Governor greg abbott announced that the federal government has updated the major disaster declaration for hurricane beryl to include 17 texas counties now eligible for. The damage left by hurricane beryl in texas and requests for federal help have opened a rift between the white house and the state’s gop leaders following the storm.

Explore The Key Provisions Of This Legislation Aimed At Providing.

The constitutional amendment to provide the largest property tax cut in texas history will be added to the texas constitution if approved by a simple majority of texas.

Under The Proposed Bill, The Maximum Refundable Amount Per Child Would Rise To $1,800 In 2023, $1,900 In 2025 And $2,000 In 2025.

A district court ruled the ftc lacks authority to issue a rule banning almost all noncompete agreements between employers and workers, and granted limited preliminary.

Category: 2025