Irs Estimated Tax Payments 2024. To register yourself online, you need aadhaar card, pan card, valid mobile number, and valid email id. Here are some important dates for 2024:

You may pay online using one of the irs’ various methods; Quarterly estimated income tax payments normally due on april 15, june 17 and sept.

If You Are Required To Make Estimated Payments, Yes, You Can Pay Them Anytime Before The Due Date Without Penalty.

January 15th 2024 is the last day to make an estimated tax payment for 2023.

Corporations Generally Must Make Estimated Tax Payments If They Expect To Owe Tax Of $500 Or More When Their Return Is Filed.

For estimated tax purposes, the year is split into four payment periods, with a specific payment due date.

Irs Estimated Tax Payments 2024 Images References :

Source: drucillwbilly.pages.dev

Source: drucillwbilly.pages.dev

Estimated Tax Payment Dates 2024 Irs Ptin Rhody Cherilyn, Estimated tax payments are periodic advance payments to the irs for income that isn’t subject to withholding. Quarterly payroll and excise tax returns normally due on april 30, july 31 and oct.

Source: drucillwbilly.pages.dev

Source: drucillwbilly.pages.dev

Estimated Tax Payment Dates 2024 Irs Ptin Rhody Cherilyn, January 15th 2024 is the last day to make an estimated tax payment for 2023. The irs has set four due dates for estimated tax payments in 2024:

Source: babbiezsazsa.pages.dev

Source: babbiezsazsa.pages.dev

2024 Estimated Tax Payment Due Dates Rhea Priscella, Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you. You’ll likely need to make these payments to the irs throughout the year.

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, Our advocates can help if you have tax problems that you can’t resolve on your own. Irs estimated tax payments basics:

Source: loneezitella.pages.dev

Source: loneezitella.pages.dev

2024 Quarterly Tax Dates Irs Katee Ethelda, Our advocates can help if you have tax problems that you can’t resolve on your own. Estimated tax payments 2024 online login.

Source: brierqverina.pages.dev

Source: brierqverina.pages.dev

Estimated Tax Payments 2024 Form Berna Cecilia, You may pay by electronic federal tax payments system (eftps). This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Source: kirstinwjenny.pages.dev

Source: kirstinwjenny.pages.dev

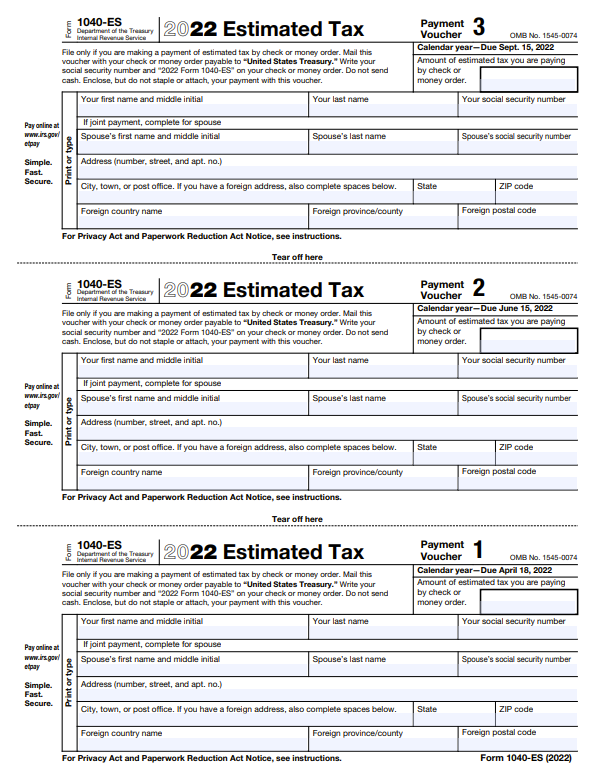

What Is 2024 Form 1040Es Payment Voucher Peg Shaylynn, Make payments from your bank account. Quarterly estimated tax payments for the 2024 tax year will be due:

Source: lynettewvanya.pages.dev

Source: lynettewvanya.pages.dev

Estimated Tax Payment Dates 2024 Pay Online Ricky Christal, Extended due date for 2023 domestic trust, estate, and partnership tax returns. Irs estimated tax payments basics:

Source: kialqcacilie.pages.dev

Source: kialqcacilie.pages.dev

State Of Maryland Estimated Tax Payments 2024 ashly lizbeth, Information you’ll need your 2023 income tax return. You’ll likely need to make these payments to the irs throughout the year.

Source: www.youtube.com

Source: www.youtube.com

Estimated Tax Payments YouTube, This section will help you determine when and how to pay and file corporate income taxes. After the end of the year, the corporation must file an income tax return.

Use This Secure Service To Pay Your Taxes For Form 1040 Series, Estimated Taxes Or Other Associated Forms Directly From Your Checking Or Savings Account At No Cost To You.

Estimated tax payments 2024 online login.

Taxpayers Can Now Pay Their Taxes Online Through The E.

Estimated tax payments are periodic advance payments to the irs for income that isn’t subject to withholding.

Posted in 2024