Irs Limits 2024 For 401k. The irs has announced the 2024 contribution limits for retirement savings accounts, including contribution limits for 401 (k), 403 (b), and 457 (b) plans, as well as income. As of 2023, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

Limits are still increasing in 2024, just not as significantly. Those 50 and older can.

For 2024, The 401 (K) Annual Contribution Limit Is $23,000, Up From $22,500 In 2023.

Those 50 and older can.

The Internal Revenue Service (Irs) Has Announced That Contribution Limits For 401 (K)S, 403 (B)S, Most 457 Plans, Thrift Savings.

The roth ira contribution limits in 2024 were raised to $7000, or $8000 for taxpayers 50 and older.

401 (K) Contribution Limits For 2024.

Images References :

Source: valenkawkit.pages.dev

Source: valenkawkit.pages.dev

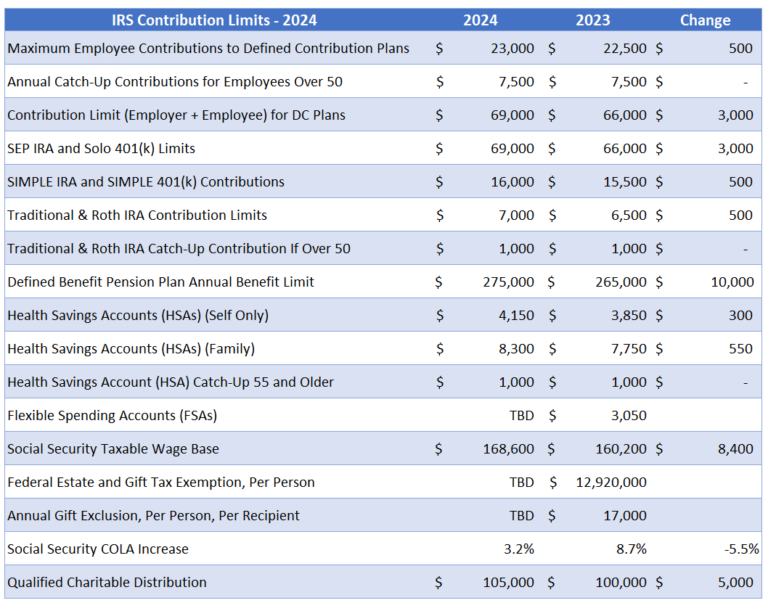

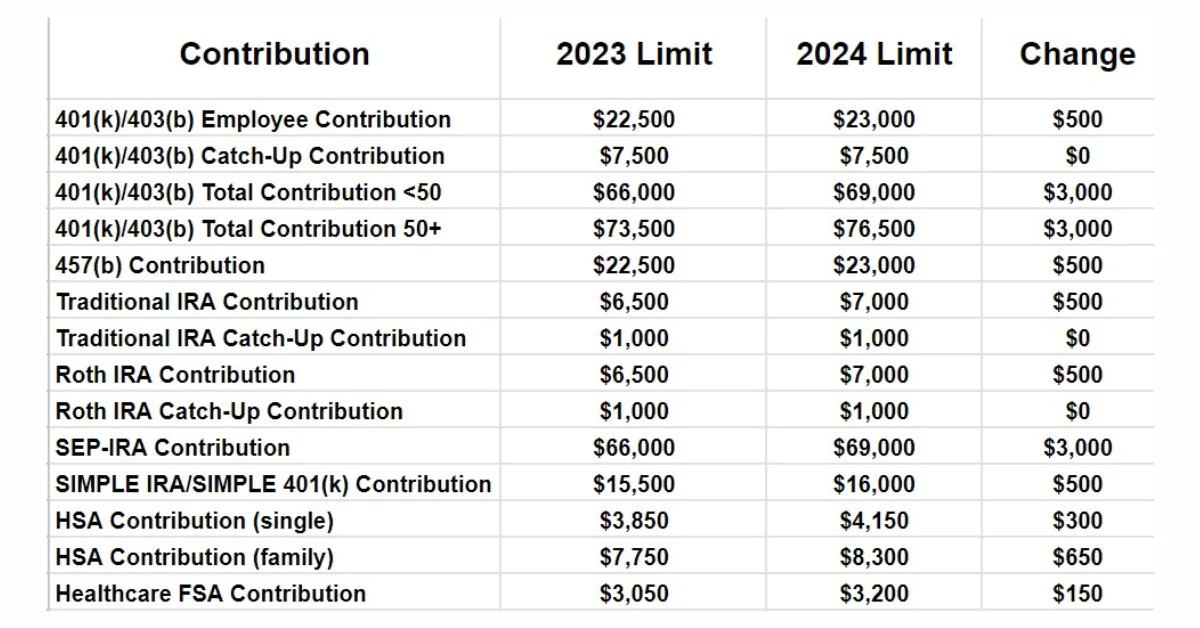

Deadline To Contribute To 401k For 2024 Camel Corilla, For 2024, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2023. If you participate in a 401 (k) retirement savings plan at work, your personal contribution limit in 2024 is $23,000.

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, The irs adjusts this limit. The dollar limitations for retirement plans and certain other.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024. The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that.

Source: sherillwlian.pages.dev

Source: sherillwlian.pages.dev

401k Contribution Limits 2024 Limits Molly Therese, For 2024, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. If you participate in a 401 (k) retirement savings plan at work, your personal contribution limit in 2024 is $23,000.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Just like 401(k) plans, the irs sets limits for how much savers can contribute to their ira plans in a given year. This amount is an increase of.

Source: valmaqvannie.pages.dev

Source: valmaqvannie.pages.dev

401k Matching Limits 2024 Allis Bendite, Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year. But if you are age 50 or older, you can take.

Source: newsd.in

Source: newsd.in

IRS 401K Limits 2024 How will the 401k plan change in 2024?, The dollar limitations for retirement plans and certain other. The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that.

Source: virgilhr.com

Source: virgilhr.com

IRS Increases 401(k), IRA Limits for 2024 VirgilHR, For 2024, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs.

Source: moneymonarchs.com

Source: moneymonarchs.com

401k 2024 Contribution Limit IRS Under SECURE Act 2.0, Those 50 and older can contribute an additional. The irs has increased the contribution limit for 401 (k) plans for 2024 so individuals can now contribute up to $23,000.

Source: www.sequoia.com

Source: www.sequoia.com

The IRS Announces New 401(k) Plan Limits for 2024 Sequoia, The basic limit on elective deferrals is $23,000 in 2024, $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in. Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024.

In 2022, The Most You Can Contribute To A Roth 401(K) And Contribute In Pretax Contributions To A Traditional 401(K) Is $20,500.

401 (k) pretax limit increases to $23,000.

If You Participate In A 401 (K) Retirement Savings Plan At Work, Your Personal Contribution Limit In 2024 Is $23,000.

For 2024, the 401 (k) annual contribution limit is $23,000, up from $22,500 in 2023.