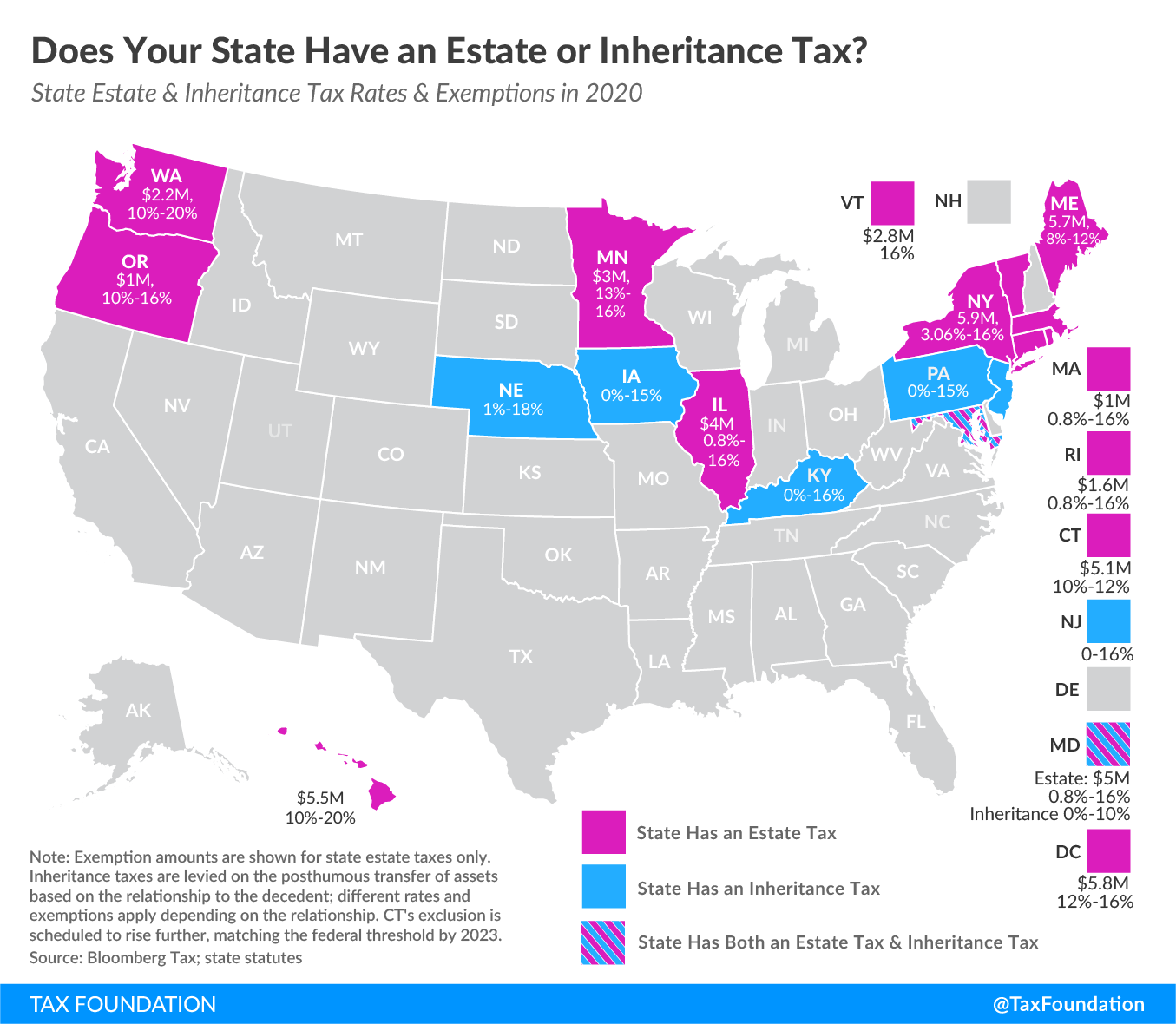

Massachusetts Estate Tax 2024. Draft guidance issued on recent corporate excise changes the massachusetts department of revenue has. Under current law, estates with a gross value over $1 million are subject to taxation, starting at a rate of 0.8% and growing to a marginal rate of 16%.

In 2023, massachusetts finally increased its estate tax threshold, although barely. Under current law, estates with a gross value over $1 million are subject to taxation, starting at a rate of 0.8% and growing to a marginal rate of 16%.

A New Era For Estate Tax In Massachusetts:

The bill is now awaiting passage by the senate before it is signed by.

For Individuals Dying On Or After January 1, 2023, The New Law.

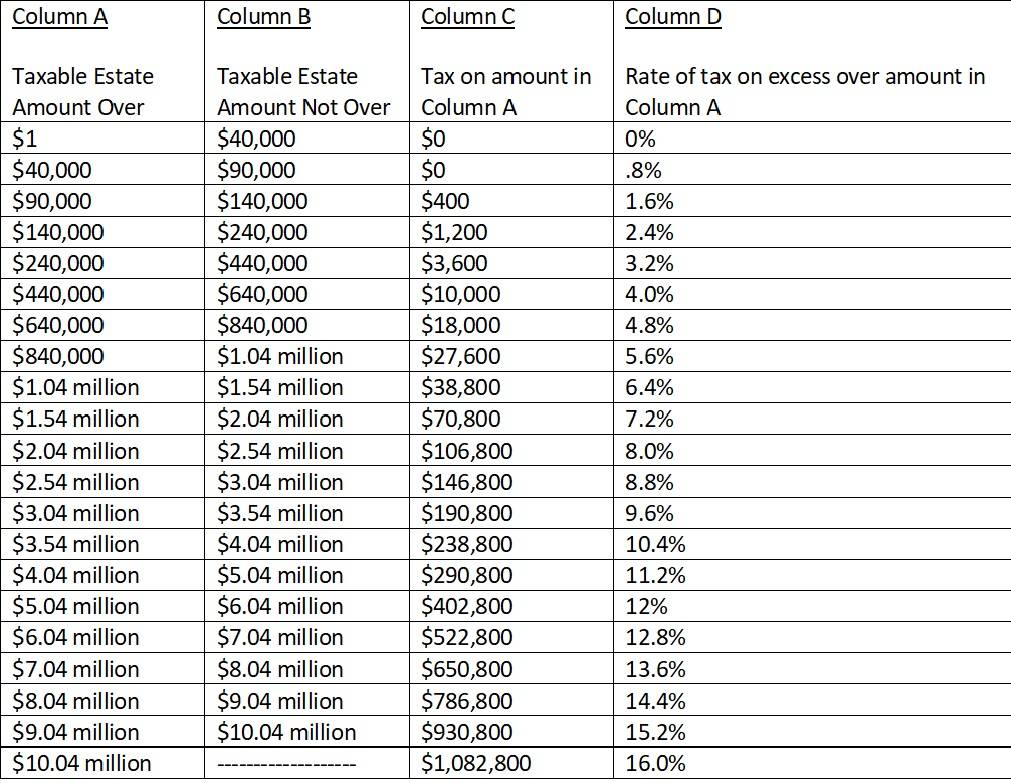

Learn what is involved when filing an estate tax return with the massachusetts department of revenue (dor).

Currently, The Estate Tax Filing Threshold In Massachusetts Is $1,000,000.

Images References :

Your Guide to Navigating the Massachusetts State Estate Tax Law, Fact checked by chris thompson. This is the first increase in the massachusetts.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, Meanwhile, homebuilder stocks rose on the news: The estate tax is a transfer tax on the value of the.

Source: www.pdffiller.com

Source: www.pdffiller.com

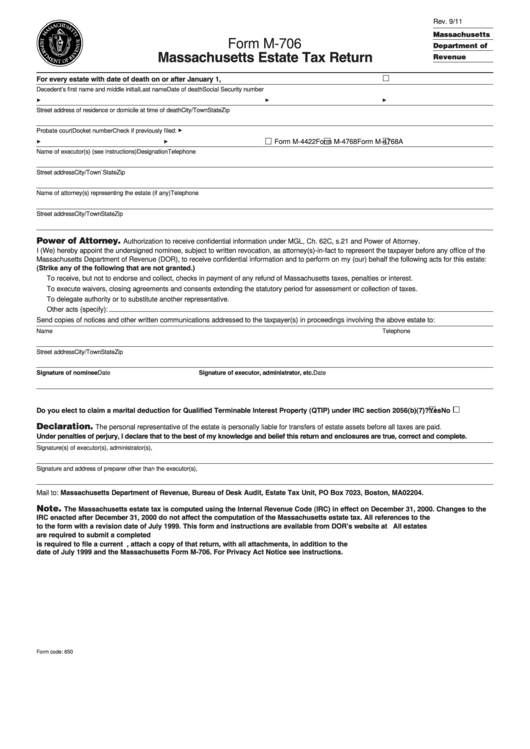

20202024 MA State Tax Form 2 Fill Online, Printable, Fillable, Blank, The new massachusetts $2 million estate tax may or may not include lifetime taxable gifts within the threshold. Including how to calculate the maximum federal credit.

Source: virtualestateattorney.com

Source: virtualestateattorney.com

The Massachusetts Estate Tax Explained Timothy J. Erasmi, Esq, Boston — tax cuts signed into law in october by massachusetts gov. The estate tax is a transfer tax on the value of the.

Source: brokeasshome.com

Source: brokeasshome.com

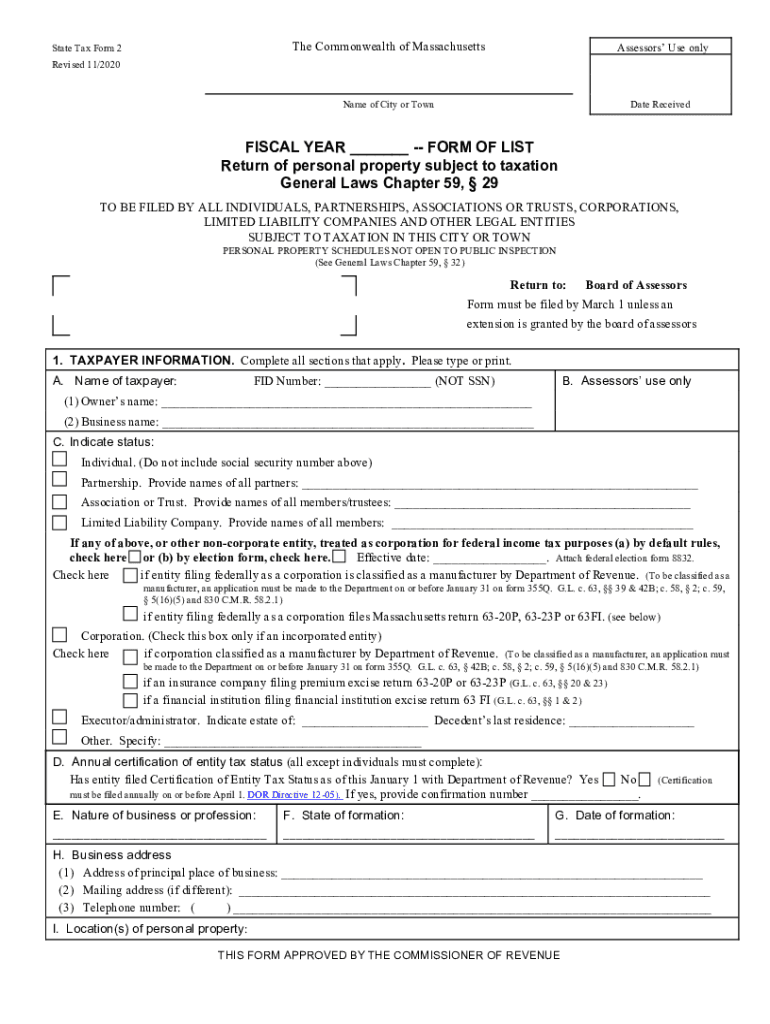

Massachusetts Estate Tax Table, The tax on the amount over $2 million will be calculated on a graduated scale, beginning at 7.2% to a maximum of 16% for estates in excess of. Increased massachusetts estate tax exemption amount.

Source: printableformsfree.com

Source: printableformsfree.com

Massachusetts Tax Forms Fillable Pdf Printable Forms Free Online, This is the first increase in the massachusetts. The new law amended the estate tax by providing a credit of up to $99,600, thereby eliminating the tax for estates valued at $2 million or less and reducing the tax for estates valued at more than $2 million.

Source: pangeaanimation.blogspot.com

Source: pangeaanimation.blogspot.com

Massachusetts Estate Tax Rates Table Estate Tax Current Law 2026, Meanwhile, homebuilder stocks rose on the news: By rachel wasselon october 9, 2023.

Source: alhambrapartners.com

Source: alhambrapartners.com

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, Under current law, estates with a gross value over $1 million are subject to taxation, starting at a rate of 0.8% and growing to a marginal rate of 16%. What to know about the recent change to the massachusetts estate tax.

Source: suburbs101.com

Source: suburbs101.com

Massachusetts Property Tax Rates 2023 (Town by Town List with, Written by ben geier, cepf®. Tax (twist) 22nd january 2024 massachusetts:

Source: suburbs101.com

Source: suburbs101.com

Massachusetts Property Tax Rates 2023 (Town by Town List with, Updated on january 3, 2024. Massachusetts has passed a sweeping $1 billion tax relief.

The Tax On The Amount Over $2 Million Will Be Calculated On A Graduated Scale, Beginning At 7.2% To A Maximum Of 16% For Estates In Excess Of.

The house bill has a similar projected impact to the fiscal year 2024 budget at about $587 million, but that total would eventually increase to close to.

Written By Ben Geier, Cepf®.

If you are responsible for the estate of someone who died, you may.